PEOs: Good for Businesses and Their Employees

Introduction

This report, highlighting the effects that partnering with professional employer organizations (PEOs) has on small and mid-sized businesses and their employees, is the fifth in NAPEO’s series of white papers designed to help the general public and the small and mid-sized business community better understand the economic impact and value of the PEO industry. It uses comprehensive survey data from both small and mid-sized business owners and their employees to examine the differences in a variety of key areas between companies that use PEOs and comparable companies that do not use PEOs. The analysis focuses on the following key areas: business success (financial, as well as competitiveness, innovation, customer service); multiple components of a company’s work, learning, and leadership environments; employee satisfaction/engagement/turnover; satisfaction with PEO services (asked of PEO clients only); and business owners’ concerns about meeting various business challenges. The analysis finds that working with PEOs yields a broad range of positive effects for PEO clients.

Quick Summary

Advantages of Using a PEO for Small and Mid-Sized Businesses

• Annual median revenue growth for PEO users was twice that of comparable non-PEO firms;

• Expected annual median revenue growth for PEO clients is 40 percent greater than that of comparable non-PEO firms;

• PEO client firms were 16 percent more likely to report an increase in profitability; and

• PEO users are significantly less concerned than non-PEO users about their ability to handle key business challenges:

o Hiring employees (45 percent of PEO clients reported this was a “moderate” or “major” concern, versus 70 percent of non-PEO firms);

o Increasing revenues (73 percent of PEO clients reported this was a “moderate” or “major” concern, versus 90 percent of non-PEO firms); and

o Raising capital/funding (18 percent of PEO clients reported this was a “moderate” or “major” concern, versus 45 percent of non-PEO firms).

Advantages of a PEO for Employees

Compared to employees working in businesses that are not PEO clients, employees working in businesses that are PEO clients are significantly more likely to report that their employer:

• Demonstrates a commitment to them as employees (average response was +8 percentage points higher);

• Has good hiring practices (+8);

• Has good HR policies and practices (+5);

• Does a good job of designing employees’ jobs (+4); and

• Provides employees with good training and development opportunities (+4).

Employees of PEO clients also report significantly higher scores on key measures related to employee satisfaction and confidence in company management:

• Levels of employee engagement (+5);

• Intention to stay with their current employer until retirement (+8);

• Belief that employer is taking the right steps to be competitive (+8);

• Trust that employer is supporting employees in delivering excellent customer service (+7); and

• Confidence in employer’s approach to growing the company (+5).

Business Owner Assessment of PEOs

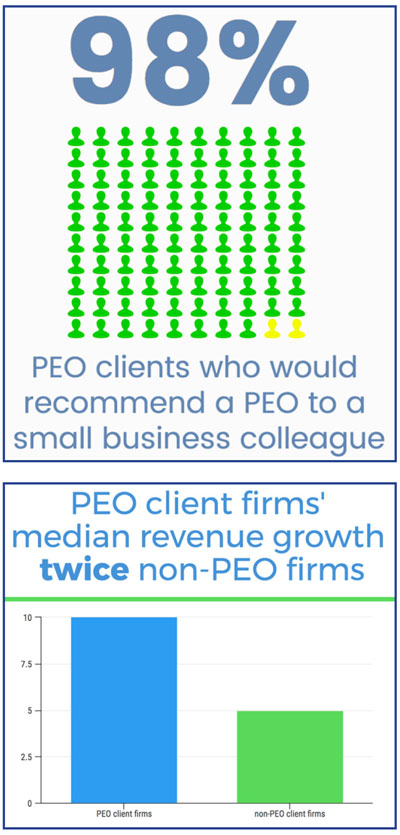

• 98 percent of business owners who are PEO clients would recommend a PEO to a small business colleague.

Analysis of Business Owner Survey Results

The analysis reported in this section is based on data that business owners provided through a business-level survey completed as part of signing up for the free employee survey service (see Section Three: Methodology). Except where otherwise noted, this analysis used the main comparison set described in the Methodology section (Set #1).1

Clients’ direct assessments of PEOs

As part of the business owner survey, we asked those respondents who are PEO clients questions about three aspects of their experience while being a PEO client. The results were:

• 98 percent would recommend a PEO to a small business colleague;2

• 70 percent report that their revenues have increased since becoming a PEO client; and

• 66 percent report that their profitability has increased since becoming a PEO client.

Business success: growth and profitability

The business-level survey also asked multiple questions about revenue change and profitability:

• The approximate percentage change in the company’s revenues from 2015 to 2016;

• The approximate expected percentage change in the company’s revenues from 2016 to 2017; and

• Whether the company’s profits decreased, stayed about the same, or decreased from 2015 to 2016.

Comparison Set #2 (which excluded not-for-profit firms, as described in the Methodology section) was used for this analysis to ensure that effects on profits and revenues were calculated using only for-profit companies.

We found substantial differences for all three items, with results higher for PEO clients than for non-PEO clients:

• PEO client firms’ median revenue growth3 from 2015 to 2016 was twice that of comparable non-PEO firms (10 percent versus 5 percent);

• PEO client firms’ expected median revenue growth from 2016 to 2017 was 40 percent greater than that of comparable non-PEO firms (14 percent versus 10 percent); and

• PEO client firms were 16 percent more likely to report an increase in profitability from 2015 to 2016 (58 percent versus 50 percent).

Business success: employee turnover

The business-level survey also asked about voluntary and involuntary turnover, but we did not find any statistically significant differences in turnover measures between PEOs client firms and non-PEO firms.4

However, in light of our previous analysis for NAPEO, “Professional Employer Organizations: Keeping Turnover Low and Survival High,”5 which was based on a very different and much larger data base and found that PEO clients have employee turnover that is 10 to 14 percentage points lower than non-PEO clients, this lack of difference in turnover can likely be attributed to the heterogeneity of the sample (and its smaller size).

Business owners’ ability to meet various business challenges

In the business-level survey, business owners were also asked about their level of concern about a number of issues that affect business operations and success.

1 Throughout Sections One and Two, those comparisons of PEO clients and non-PEO clients that are statistically significant at a 90 percent or greater confidence level are specifically highlighted as “significantly” higher or lower. Other differences that do not meet the usual threshold for statistical significance are also discussed and can still be considered meaningful. Such results are especially typical in relatively small sample sizes like the ones used in this analysis, as discussed in additional detail in the Methodology section.

2 Although it would be an overstatement to attribute all of the increase in PEO clients’ revenues and profitability to PEOs (because firms typically grow and become more profitable with the passage of time), these findings are consistent with the other growth and profitability findings, described in the section that follows.

3 For measures with wide ranges (such as revenue growth or profitability) in small samples such as the one used in this analysis, the median is typically a more reliable measure than the mean, as it helps to ensure that one or more “outliers” do not have a disproportionate impact on the average (outliers can have a major effect on the mean but not on the median).

4 This was the case for comparison Sets #1 and #2, as well as the entire sample of 101 companies.

5 Laurie Bassi and Dan McMurrer, “Professional Employer Organizations: Keeping Turnover

Most of the differences between PEO client firms and non-PEO firms indicated lower concerns among PEO clients, but most were not statistically significant.

Three concerns did generate statistically significant differences when comparing PEO clients to non-PEO clients. In all three cases, there was less concern among business owners who were PEO clients:

• Hiring employees (45 percent of PEO clients reported this was a “moderate” or “major” concern, versus 70 percent of non-PEO firms);

• Increasing revenues (73 percent of PEO clients reported this was a “moderate” or “major” concern, versus 90 percent of non-PEO firms); and

• Raising capital/funding (18 percent of PEO clients reported this was a “moderate” or “major” concern, versus 45 percent of non-PEO firms).

Analysis of Employee Survey Results

The analysis reported in this section is based on employee survey data collected from 1,588 employees—1,143 of whom worked in PEO client firms and 445 of whom worked in non-PEO firms.7 A brief word on scoring for the employee survey: All but one survey question was presented as a statement for which respondents were asked to select their level of agreement, ranging from “strongly disagree” (scored as 0), “disagree” (25), “neutral” (50), “agree” (75), or “strongly agree” (100). Most discussions of the survey results below refer to the average score on a question or category of questions, with average scores ranging from 0 to 100 as indicated.

Business success factors: competitiveness and innovation

The employee survey included four questions that asked employees to evaluate their firm’s actions on what might be considered “summative” business success factors: taking steps to be competitive, to provide excellent customer service, to grow, and to be innovative (see Table 1).

On average, scores were 7 percentage points higher on these questions from employees of PEO clients. The differences in average responses between the two groups of employees were statistically significant for three of the four questions.8

These findings are consistent with the expectation that business owners who are PEO clients do not need to spend as much time dealing with “people issues,” and therefore have more time to focus on their core businesses, making them better able to take steps to position their businesses to be competitive and successful.

Quality of HR practices

Three survey questions asked employees to evaluate the quality of HR practices at their businesses. Across the three questions, on average, PEO clients had responses that were 7 percentage points higher than those from non-PEO clients (see Table 2). Differences in average responses were statistically significant for all three items.

These findings confirm that PEOs help their clients do a better job on the “people side” of their businesses.

<

Employee engagement and intent to stay

Two survey questions gauge employee satisfaction and engagement (see Table 3 for average scores), while a third question asks about employees’ intent to stay working for their employers9 (see Table 4 for percent selecting each response option). Overall, the average score on these three

6 Although the analysis reported here is based, unless otherwise noted, on the main subsample of 60 firms (using comparison Set #1, as discussed in the Methodology section), the results are quite similar to those that we found based on the entire sample of 101 firms (for which the firms are not quite as comparable across the PEO and non-PEO groups), as well as for comparison Set #2 (for-profit firms only).

7 These numbers reflect responses included in the main comparison Set #1. The entire sample included 3,054 employee survey responses (2,457 from PEO clients and 597 from non-PEO clients).

8 Only the differences for “our company is taking the right steps to enable our business to grow” did not meet the statistical test for significance.

questions was 5 percentage points higher for employees in PEO client firms compared to their peers in non-PEO firms. The difference in responses between the two groups of employees was statistically significant for the intent-to-stay question. We also found that intent to stay varied with how long a business has been a PEO client (see Table 5). Overall, the findings on engagement and intent to stay suggest that PEOs are able to help business owners create a more engaging work environment by better management of the “people side” of the business, combined with an improved ability to focus on the factors that drive business success (see the items in Table 1 on page 4), and that some of these impacts may increase the longer a business has been a client of a PEO.

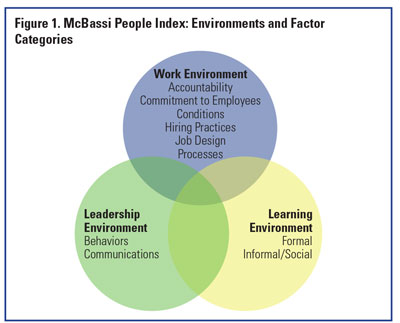

Work, learning, and leadership environment Most of the questions asked in the employee survey were drawn from the McBassi People Index, which is an intensively researched measurement system designed to quantify key elements across a wide range of an organization’s peoplerelated environment.

The conceptual framework that serves as the basis for the employee survey is displayed in Figure 1, above.10 The framework consists of three environments on the “people side” of an organization that combine to drive business results: leadership, work, and learning. It was our expectation that largest difference in responses between employees in PEO client firms and their peers in non-PEO firms would be found in the Work Environment category, followed by Learning Environment. We did not expect to find significant differences in the Leadership Environment (because PEO services are not typically designed to address issues such as supervisors’ behaviors and communications, which make up the Leadership Environment category).11 Indeed, this is precisely the pattern we found (see Table 6).

9 The “intent to stay” question is the one question on the survey that uses a different response scale than the “strongly disagree” (0) to “strongly agree” (100) 5-point scale used for all other items. Table 4 therefore reports percentages by response rather than the overall average score. For comparison purposes, the average scores on this item, using the same 0 to 100 scale, were 69 for employees of PEO clients and 63 for employees of non-PEO clients. 10 In addition to our six standard Work Environment categories, as indicated in this figure, we added one new category for the NAPEO employee survey. The “HR” category was added in order to be able to directly examine differences between PEO clients and non-PEO clients on employees’ assessments of HR policies and practices. 11 The six questions in the Leadership category in the employee survey related to supervisors: the extent to which they eliminate barriers to effective work, exhibit principled and ethical behavior, seek and use employee input, provide frequent feedback, communicate clearly, and facilitate free communications.

The specific survey questions (17 of the 32 overall questions) for which there was a statistically significant difference in the response of employees in PEO client firms and those in non-PEO firms are noted in Table 7.12

Analysis sample

The project was designed specifically to collect comparable data from both PEO clients and comparison groups of non-PEO clients on the measures discussed above, thereby enabling us to compare the two groups across multiple categories. To create an incentive for businesses to provide the information needed for this study, NAPEO and McBassi offered a free 2017 employee survey (including a detailed results report with benchmarking comparisons) to any business that did both of the following:

• Enrolled in the survey by completing a business-level

survey with questions on a variety of financial measures

and other elements related to business owners’

perspectives; and

• Invited its employees to respond to a 32-question survey

and receive responses from at least 50 percent of the

employees invited (with five or more total responses).

NAPEO member PEOs represented the primary distribution vehicle for the employee survey offer.13 The participating PEOs offered the free survey to their clients and were asked to offer it to non-clients as well. In many cases, these “non-clients” were either prospective clients or ASO (administrative services only) clients from another branch of the PEO. Such organizations represent particularly appropriate comparisons for PEO clients because both prospective clients and ASO clients known to participating PEOs would be expected to share many qualities, both tangible and intangible, with PEO clients.

The project, including the surveys of business owners and their employees, was conducted from April through June 2017.

Sample size

A total of 101 firms met the standards listed above, of which 71 were PEO clients and 30 were not PEO clients.15 The firms then filtered using two different criteria to ensure that our comparisons used groups of PEO client firms and non-PEO client firms that were similar to one another:

• Main comparison set (Set #1): The first filtering process eliminated from the analysis group any business that did not have at least one similar business in the comparison group. “Similar” was defined as being in the same economic sector (i.e., same industry) and having a number of employees that was between 50 and 150 percent of the number of employees for at least one corresponding business in the same sector. This filtering process left a sample of 60 firms, 40 of which were PEO clients, and 20 of which were not PEO clients.

12 Overall, 31 of the 32 questions had a positive difference (higher score for PEO clients than for non-PEO clients). The one exception was “I freely communicate my opinions and ideas to my supervisor,” for which average scores were slightly higher among non-PEO clients.

13 A total of 12 different PEOs generated at least one participating business that met the standards above. Most participating PEOs made the offer available widely to their client bases.

14 To help increase the sample size, additional efforts were made to recruit non-PEO clients through other entities as well (primarily through McBassi and NAPEO contacts), although in the end only 10 percent of non-PEO clients in the sample came from efforts outside the main PEO distribution channels.

15 The non-PEO client group includes three companies that had been PEO clients for two months or less at the time of enrollment. Because the impact of PEOs on these new clients would be expected to be minimal in early months, we included those companies in the non-PEO comparison group for the analyses.

The sizes of these two groups were large enough for valid comparisons and statistical analysis. They were relatively small samples by the standards of social science research, however, and any statistically significant findings that emerged were therefore particularly notable in light of the difficulty in finding statistical significance in smaller samples.16

This main comparison set was the sample used for most of the analyses described in this paper.

• Comparison Set #2 was used only for comparing financial outcomes from business owners, and therefore included only for-profit businesses (i.e., the not-for-profits were removed from Set #1 to create Set #2). This left a sample of 52 businesses, 36 of which were PEO clients and 16 of which were not PEO clients.

As seen in Table 8, the general characteristics of the 60 firms in the main comparison set are roughly comparable between PEO clients and non-PEO clients.

Business outcomes examined

As noted above, there were two components to a company’s participation in the project: a business-level survey and an employee survey. We used data from the business-level survey (i.e., the business owners’ enrollment form) to measure how the following outcomes varied between PEO clients and non-PEO clients:

• Clients’ direct assessments of PEOs (PEO clients only);

• Business success: growth and profitability;

• Business success: employee turnover; and

• Business owners’ ability to meet various business challenges.

We used data from the employee survey to measure how the following outcomes varied between PEO clients and non-PEO clients:

• Business success factors: competitiveness and innovation;

• Quality of HR practices;

• Employee satisfaction; and

• Multiple other elements of an organization’s work, learning, and leadership environment.

Conclusion

The results described in this paper, based on data collected directly from both business owners and their employees, indicate that PEOs have a significant positive impact on their clients in a variety of important ways.

The findings show that PEOs help their clients achieve better revenue growth and profitability. Clear results also illustrate that they help to improve their clients’ HR policies and practices, employees’ work environment and satisfaction/engagement, and businesses’ ability to focus on factors that drive business success. PEO clients also overwhelmingly indicated they would recommend PEO services to small business colleagues.

The overall pattern of results is important as well in helping to confirm the nature of the analytic results. In particular, substantial and positive differences were found on many of the specific issues that PEOs focus on, while no significant differences were found on many other issues not directly targeted by PEOs. Analytically, the expected lack of differences in some areas serves to underscore the existence of real differences elsewhere. In other words, it’s not just that the PEO clients have higher scores on everything in the analysis—their higher scores illustrate the specific impacts of PEO services.

16 Throughout the paper, those results that are statistically significant at a 90 percent or greater confidence level are specifically highlighted as “statistically significant.” Because of the relatively small sample size, many other results and differences between groups do not meet the statistical definition of significant. Many of those results are discussed in the paper and can still be considered meaningful as well. Statistical significance for employee survey items