An Economic Analysis: The PEO Industry Footprint

Highlights

Professional employer organizations (PEOs) provide an array of HR services and employee benefits to client organizations, typically small- to mid-sized businesses. This frees those clients to focus their primary efforts on the core business itself, including operations, strategy, and innovation. Our previous research on a variety of measures has found that this arrangement yields significant benefits to PEO clients, as they grow more quickly than comparable other businesses, doing so with lower rates of employee turnover and higher rates of year-to-year business survival. Anecdotally, evidence points to a growing PEO industry driven by a rebounding small business sector, an increase in the use of outsourcing by small businesses, and the rise of complicated employment regulations such as the Affordable Care Act (ACA). Precisely calculating the size of the industry, however, has proved to be tricky due to the fact that traditional sources such as the U.S. Bureau of Labor Statistics (BLS) and Hoovers do not accurately define PEOs and often include non-PEOs in the category. This white paper therefore examines that question from multiple perspectives using a variety of data sources.

We calculate the current size of the PEO industry to be between $136 and $156 billion, as measured in gross revenues (which includes clients’ payrolls as well as the fees charged to clients). PEOs provide services to between 2.7 and 3.4 million worksite employees for 156,000 to 180,000 clients, and employ between 21,000 and 27,000 internal employees. We estimate there are between 780 and 980 PEOs currently operating in the United States.

Table 1, below, summarizes the key statistics that emerged from this industry analysis. Ranges provided are large due to the vagaries of the data, as noted above. These numbers indicate the PEO industry has grown significantly since the PEO concept first began to take hold three decades ago. In each of the last 30 years, the industry has added, on average, roughly 100,000 worksite employees and 6,000 net new clients. For perspective, that means that every five years, the PEO industry has added the employment equivalent of the entire utilities industry in the United States.

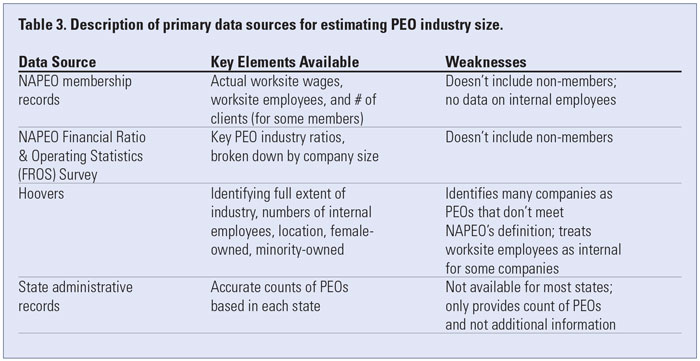

Multiple data sources were used to make the calculations in this paper, with primary focus on the following:

• NAPEO membership data;

• BLS data;

• NAPEO’s 2014 Financial Ratio & Operating Statistics (FROS) Survey;

• Hoovers/Dun & Bradstreet data on all companies classified as PEOs by Hoovers; and

• Detailed administrative data from five selected states.

No single data source contains enough information by itself to accurately estimate the size of the industry, so we sought to combine the best (and most reliable) components of each in order to make the most accurate estimate possible. The lower-bound estimates are based on the most conservative assumptions for those areas where quantitative parameters are not precisely known, while higher-range estimates are based on less conservative assumptions.

We found that data on the PEO industry (from major business databases such as Hoovers, as well as from the BLS), often over-counts PEOs, typically by including businesses that do not meet the traditional definition of PEO and/or by mixing worksite employees and internal employees in reporting employee counts. Our calculation methods and manual data reviews were therefore designed specifically to avoid both of those problems, which can be inherent in more automated data gathering and reporting methods.

The estimated 2.7 to 3.4 million employees who benefit from PEO services is a number larger than the size of the entire agriculture/forestry industry in the United States (and close to the size of the federal government, the education sector, or the information sector), based on data from the BLS.1 The estimated 780 to 980 PEOs operating in the United States thus touch a substantial number of U.S. employees across some 156,000 to 180,000 different client organizations. And, earlier findings2 that PEO clients have higher rates of growth, are significantly less likely to go out of business from one year to the next, and have notably lower rates of employee turnover suggest that PEOs are exerting a positive influence on the U.S. economy as a whole, making it possible for many small- and mid-sized enterprises to focus more successfully on their core work, while simultaneously serving as a stabilizing force in

employment by reducing unwanted employee turnover among PEO clients.

Notably, PEOs are doing this despite employing only a modest number of internal employees of their own: fewer than 30,000 total internal employees in total. This underscores the tremendous leverage of those internal PEO employees, whose positive effects are felt across an employee base larger than the entire U.S. agricultural sector.

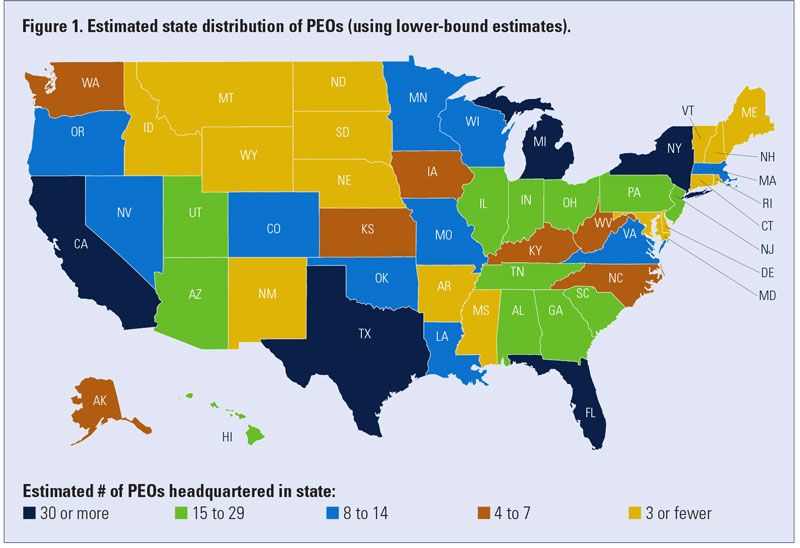

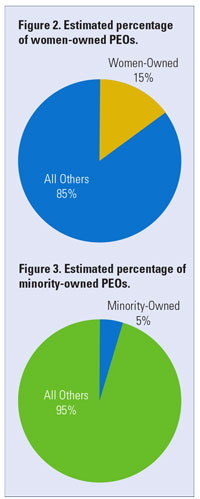

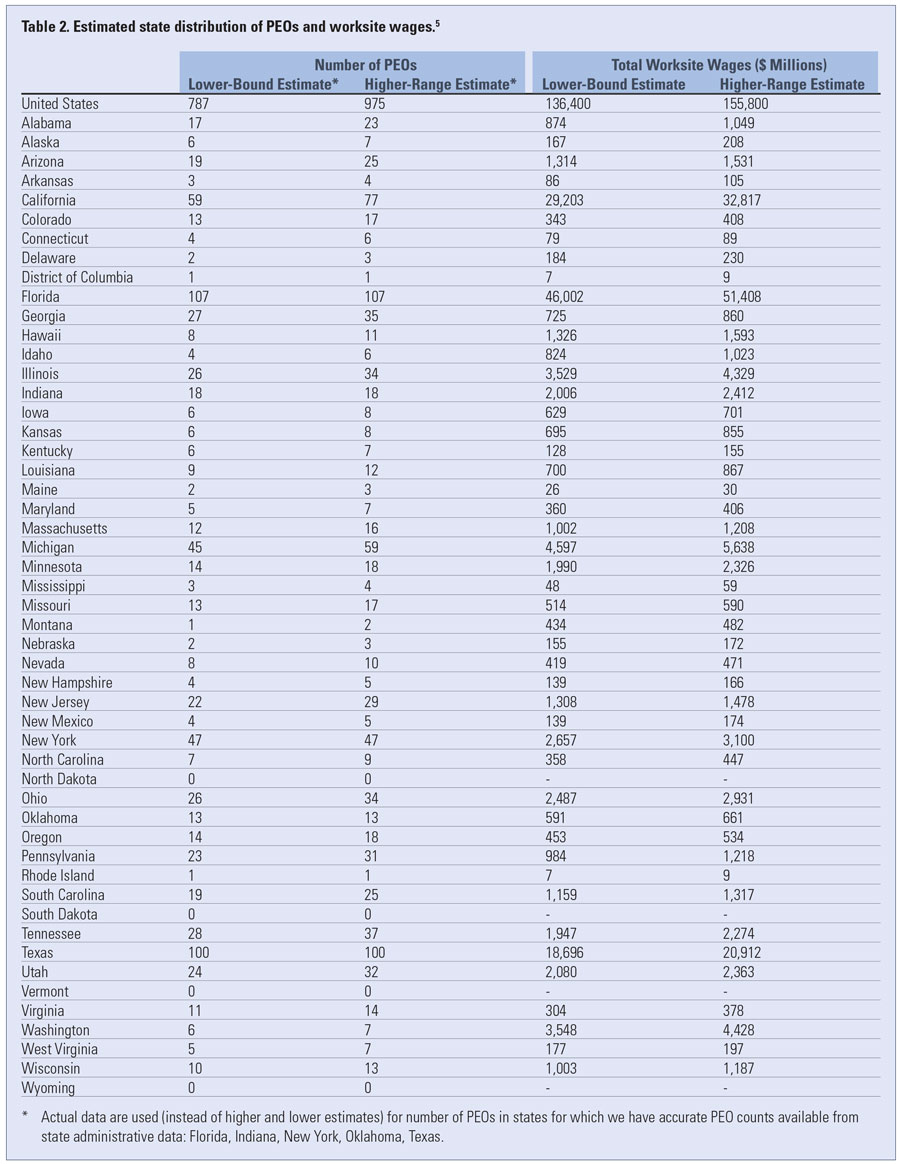

We were also able to use data from the combined databases to estimate the distribution of PEOs (and worksite wages) across states (see Figure 1 and Table 2, page 4), and used Hoovers data to estimate the percentage of women-owned and minority-owned businesses in the PEO industry. An estimated total of 15 percent of all PEOs are womenowned, 3 while 5 percent are minority-owned4 (see Figures 2 and 3). Both of these percentages are lower than the percentages of women-owned and minority-owned businesses in the United States as a whole (30 percent for women-owned and 21 percent for minorityowned), suggesting one potential challenge for the PEO industry to address in the years ahead.

Overall, the findings point to a PEO industry that is significant in size and scope, distributed broadly across the country, and well-positioned to continue to have a positive economic impact on its clients and, by extension, on the U.S. economy overall.

The remainder of this report contains additional, more technical, details on the analysis, findings, and

calculation methodology.

Detailed Description of Analysis and Findings

How large is the PEO industry?

We estimate a range for PEO industry size. Our first calculations apply conservative assumptions wherever applicable, and thus represent lower-bound estimates (essentially, the “floor” for each value). Based on the conservative set of assumptions, we calculate the PEO industry in the United States to be at least $136 billion, as measured in gross revenues (which includes clients’ payrolls as well as the fees charged to clients). Conservative estimates indicate there are at least 780 PEOs that combine to provide services to at least 2.7 million worksite employees in at least 156,000 client organizations, while employing approximately 21,000 internal employees of their own.

A second, less conservative, set of estimates and calculations points to an industry about 15 to 30 percent larger than the more conservative estimates: gross revenues of up to $156 billion, 3.4 million worksite employees in 180,000 client organizations, and 27,000 internal employees distributed across almost 1,000 PEOs.

Both sets of calculations take into account the most significant source of potential error in the lower-bound calculations: the extent to which some PEOs are missing from both NAPEO membership data and the Hoovers data. As described below, we used available state administrative data for five states to estimate the percentage of PEOs from those states that were not included in the combined NAPEO and Hoovers data. We then applied percentages from the combined set of five states to the national totals (while also assuming that any PEOs missing from both databases would be, on average, smaller than the average PEO).

We are confident that the ranges reported above represent accurate, analytically responsible estimates of the true size of the full PEO industry

What sources of data were used for the calculations?

To calculate industry size, we relied on information from the following sources:

• Current NAPEO member records, including data on actual worksite wages, worksite employees, and (when available) number of clients;

• NAPEO’s 2014 Financial Ratio & Operating Statistics (FROS) Survey;

• A subscription-based database of information from Hoovers/Dun & Bradstreet containing a variety of information on those companies classified in the database as PEOs; and

• State administrative data from Florida, Indiana, New York, Oklahoma, and Texas6 to compare comprehensive counts of PEOs in each of those states with the estimates derived from the NAPEO and Hoovers databases.

We sought to combine the best elements of each data source—those elements that were the most accurate, the most reliable, or that were unavailable from any other source. The primary elements of the analysis were thus the following:

• Worksite records from NAPEO’s member files on 259 companies (including summative data from members’ IRS Form 941 records on wages and numbers of worksite employees, as well as data on number of clients when available);7

• Extensive financial detail from the FROS survey data, including breakdowns by size group of ratios such as number of worksite employees per internal employee and gross profit as percentage of total revenue;

• Basic company information (including location, size, and ownership) from Hoovers on non-NAPEO members in the PEO industry; and

• Databases of registered PEOs in five selected states to attempt to estimate what percentage of PEOs might be missing from both the NAPEO and Hoovers data.

The key elements of each primary data source are summarized in Table 3.

BLS data was also examined but was ultimately not incorporated into the calculations due to the fact that the BLS definition of the PEO industry appears significantly broader than that used by NAPEO. This is explored in additional detail in the discussion below.

Two factors unique to the PEO industry create particular challenges for purposes of calculating its size and scope:

• Because of the nature of the work done by PEOs, worksite employees are sometimes incorrectly treated as internal employees in public records and databases, with this information then reflected in the Hoovers data. This significantly exaggerates the apparent size of such companies, and means that extensive data cleaning is necessary before available databases such as Hoovers can be usefully applied to industry size calculations.

• Databases such as Hoovers also classify into the PEO industry a number of other types of companies that do not provide the full range of services traditionally associated with PEOs. The most common such companies are temporary staffing companies, but numerous other types (e.g., IT, transportation, home healthcare) are also sometimes incorrectly classified as PEOs. Significant data cleaning is required to eliminate such companies as well.

How were the industry size estimates calculated?

Our calculation model uses actual data when available (in particular, information from NAPEO members on worksite wages, worksite employees, and number of clients), supplemented by information from Hoovers, FROS, and state administrative records to enable the extension of the calculations to apply more broadly across the full scope of the PEO industry.

First, we therefore started our calculations with the NAPEO data on worksite wages, worksite employees, and number of clients. We then verified and adjusted the existing NAPEO membership data against an aggregated measure of worksite wages from the Employer Services Assurance Corporation (ESAC),a third-party accreditation organization with highly reliable, audited data for a subset of NAPEO members. We also used NAPEO’s numbers to estimate numbers of internal employees (not included in the NAPEO data) for its members. Second, several steps were taken to convert raw Hoovers data into information that could be used to supplement the NAPEO data. These included manually identifying which companies in the Hoovers data should be counted as PEOs and then

calculating or verifying as PEOs and then calculating or verifying worksite wages and worksite employees for those companies. (The Hoovers data included internal employees, but not specific information on worksite employees.) Third, we then summed the totals from Hoovers and NAPEO to generate a single industry estimate, and adjusted that estimate to include PEOs that are not a part of either database. These calculations included summing up worksite wages, worksite employees, and number of clients8 for PEO companies for which data were available (NAPEO members), and using known industry ratios to estimate internal employees for those PEOs. For those PEO

companies for which worksite data were not available (Hoovers data), we estimated worksite wages and worksite employees based on Hoovers data on internal employees (after correcting for possible errors that counted worksite employees as internal employees for some companies) and we estimated numbers of clients by applying calculated ratios based on FROS data on number of clients for various ranges of company size, using numbers of internal PEO employees to determine the appropriate size range. For those companies in the Hoovers data that were identified by Hoovers as PEOs but were not examined as part of the sample that was manually verified by NAPEO or McBassi, we accounted for the uncertainty by applying to each company a weighting factor (0.45) that exactly matched the percentage of companies that had been correctly identified as PEOs in the manual sample.

We also adjusted for the fact that some existing PEOs are not included in either the Hoovers or NAPEO databases and thus would be left out of the estimates entirely unless the data were adjusted accordingly. We did this by using administrative data from five different states where state registration of PEOs is required. We calculated the total number of PEOs in each state (after excluding out-of-state registrants and inactive corporations) as a percentage of the number included in the combined NAPEO/Hoovers data for that state. We found the states had, on average, 66 percent more PEOs than were included in the NAPEO/Hoovers count. We used actual numbers of PEOs for those five states, and applied that percentage to remaining states to enable the industry estimates as a whole to reflect companies not included in either NAPEO or Hoovers data.

As part of those calculations, we assumed the missing PEOs were smaller than average PEOs (because we had found smaller PEOs were more likely to have been excluded from the Hoovers data) but similar in all other ways (i.e., the same industry ratios on other key measures). We used two different assumptions for average company size (five employees per company and 10 employees per company). These adjustments for missing companies thus increased the overall size of the industry by 10 to 20 percent (when measured by worksite wages and fees), by 11 to 22 percent (when measured by number of worksite employees), and by 3 to 15 percent (when measured by the number of PEO clients). What about the BLS data that reports the PEO industry employs more than 300,000 employees? Based on our calculations, complemented by our experience with manually examining company-by-company data in Hoovers (which is typically drawn on publicly available sources), we believe the BLS data applies a much broader definition of PEO than is used by NAPEO (and within the PEO industry itself) and/or may incorrectly include worksite employees for some employers. We are confident that our estimates of 21,000 to 27,000 internal PEO employees are much closer to the true number for the PEO industry as it is defined by NAPEO.

How were the state distribution estimates calculated?

For the lower-range estimate of the number of PEOs in each state, we used our most conservative estimates of the full sample of NAPEO data, all Hoovers companies that were either manually confirmed as PEOs or had a weighting factor applied to account for the likelihood of being PEOs, and the estimate of the number of PEOs missing from the two databases. We used available data on primary state location to count the estimated number of PEOs based in each state and adjusted it for the estimated missing PEOs. For the higher-range estimate, we used our alternative estimates of each of the above elements.

Estimates of state worksite wages were calculated similarly, using actual NAPEO data when available, supplemented with Hoovers companies that were either manually confirmed as PEOs or had a weighting factor applied to account for the likelihood of being PEOs, and adding in estimated worksite wages for missing companies using the smallest size estimates. Worksite wages are calculated based on the state in which a PEO is located, and do not incorporate any information on clients’ locations (in other words, if a PEO in California has clients in other states, all worksite wages are assigned to California for purposes of these estimates).

How were the women-owned and minority-owned estimates calculated?

Using the full sample of Hoovers companies that were either manually confirmed as PEOs or had a weighting factor applied to account for the likelihood of being PEOs, we calculated the percentage of those companies that Hoovers had coded as women-owned or minority-owned.